Credit Strategies Fund

Mandate:

Alternative Corporate Credit

Inception Date:

January 2023

Fund Codes:

Class F CAD: NEW 701

Class F USD: NEW 701U

Class G CAD: NEW 703

Class G USD: NEW 703U

Class C CAD: NEW 707

Management Fees:

Class F 1%

Class G 2%

Class C 0.75%

Performance Fee :

15%

Liquidity:

Daily

Simplified Prospectus

Summary of Investment Portfolio

2025

2024

Fund Fact Sheet

2025

- NewGen Credit Strategies Fund – Class C (ENG)

- NewGen Credit Strategies Fund – Class C (FRE)

- NewGen Credit Strategies Fund – Class F (ENG)

- NewGen Credit Strategies Fund – Class F (FRE)

- NewGen Credit Strategies Fund – Class F USD (ENG)

- NewGen Credit Strategies Fund – Class F USD (FRE)

- NewGen Credit Strategies Fund – Class G (ENG)

- NewGen Credit Strategies Fund – Class G (FRE)

- NewGen Credit Strategies Fund – Class G USD (ENG)

- NewGen Credit Strategies Fund – Class G USD (FRE)

- NewGen Credit Strategies Fund – Class I (ENG)

- NewGen Credit Strategies Fund – Class I (FRE)

Management Report of Fund Performance

2024

- Interim Management Report of Fund Performance (ENG)

- Interim Management Report of Fund Performance (FRE)

2023

- Interim Management Report of Fund Performance (ENG)

- Interim Management Report of Fund Performance (FRE)

- Management Report of Fund Performance (ENG)

- Management Report of Fund Performance (FRE)

Financial Statements

2024

2023

The NewGen Credit Strategies Fund objective is to maximize absolute returns for unitholders over the typical corporate credit cycle by providing a combination of income and capital gains while minimizing the volatility of returns. The Fund will invest primarily in a concentrated but appropriately diversified portfolio of North American corporate bonds issued by non-investment grade publicly traded corporations and may also invest in other types of credit securities such as term loans, convertible bonds, preferred equity, and common equity securities.

To achieve the Fund’s investment objectives, the Manager will utilize a value-based fundamental credit research process to identify attractive risk adjusted return opportunities in individual investments within a diversified portfolio. The Manager has the belief that a subset of securities within the North American corporate credit universe can from time-to-time be priced inefficiently relatively to their true credit risk. The Manager will attempt to identify and exploit these inefficiencies through active management to generate total investment returns that do not track credit market indices or other high yield mutual funds in the same category.

The Fund will invest primarily in North American corporate credit securities as well as other instruments. This can include, but is not limited to high yield bonds, investment grade corporate bonds, government bonds, term loans, structured products, preferred shares, common shares, exchange traded funds, derivative products and other income generating securities. Approximately 75% of the assets of the mutual fund may be invested in foreign securities.

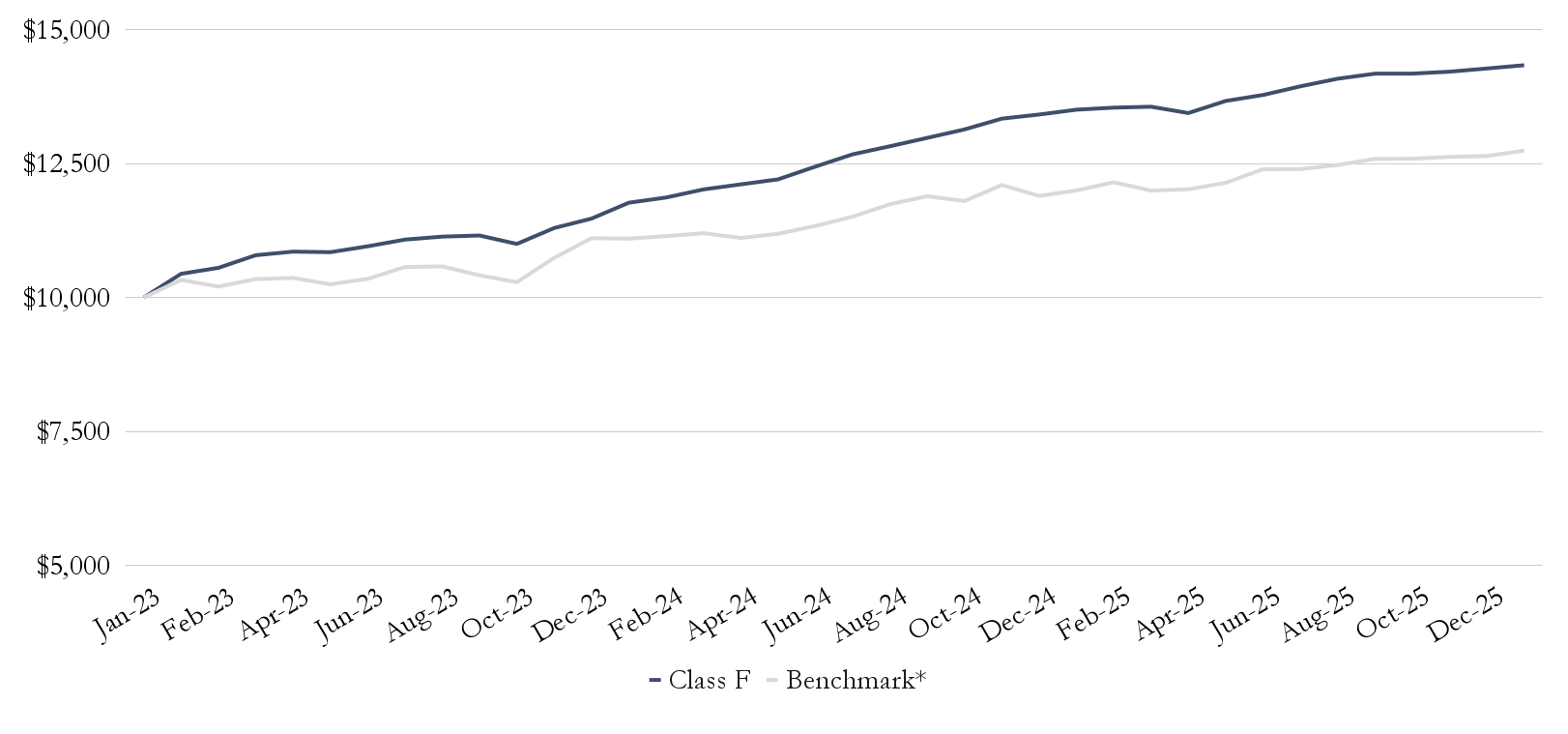

NewGen Credit Strategies: Growth of $10,000 Since Inception (Class F)

NewGen Credit Strategies (Class F)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD | ||

| 2023 | NG Credit Strategies Class F | 4.42% | 1.07% | 2.23% | 0.62% | -0.09% | 1.01% | 1.14% | 0.50% | 0.19% | -1.41% | 2.70% | 1.56% | 14.73% |

| Benchmark* | 3.28% | -1.20% | 1.36% | 0.22% | -1.16% | 1.00% | 2.13% | 0.11% | -1.58% | -1.23% | 4.41% | 3.42% | 11.07% | |

| 2024 | NG Credit Strategies Class F | 2.58% | 0.83% | 1.27% | 0.79% | 0.77% | 1.95% | 1.85% | 1.19% | 1.22% | 1.22% | 1.53% | 0.58% | 16.94% |

| Benchmark* | -0.07% | 0.42% | 0.49% | -0.79% | 0.69% | 1.31% | 1.54% | 2.01% | 1.27% | -0.75% | 2.54% | -1.69% | 7.10% | |

| 2025 | NG Credit Strategies Class F | 0.67% | 0.28% | 0.13% | -0.87% | 1.68% | 0.82% | 1.17% | 1.02% | 0.67% | 0.01% | 0.25% | 0.42% | 6.40% |

| Benchmark* | 0.86% | 1.28% | -1.29% | 0.21% | 1.01% | 2.08% | 0.02% | 0.61% | 0.92% | 0.02% | 0.26% | 0.14% | 6.27% | |

| 2026 | NG Credit Strategies Class F | 0.43% | 0.43% | |||||||||||

| Benchmark* | 0.80% | 0.80% |

*Benchmark is the total return of the iShares US High Yield Bond Index ETF (CAD-Hedged)

| 1-MTH | YTD | 1 -YR | 3-YR | 5-YR | INCEPTION |

|---|---|---|---|---|---|

| 0.43% | 0.43% | 6.2% | 11.1% | N/A | 12.4% |

Standard deviation is a form of hypothetical performance data; Sharpe Ratio, Sortino Ratio and Jensen’s Alpha are hypothetical measures of excess return and we assume a risk-free rate of 1.5% in their calculationsThis monthly distribution is fixed but not guaranteed and may be adjusted from time to time at the discretion of the fund manager.

The Fund’s current annualized yield is calculated based on the most recent monthly distribution assuming reinvestment, divided by the most recent month-end NAV

Portfolio exposures are all calculated as of the most recent calendar quarter-end

This document has been prepared by NewGen Asset Management Limited (\”NewGen\”, \”we\” or \”us\”). The information contained herein is not, and under no circumstances is to be construed as, an offer to sell or the solicitation of an offer to buy any securities nor does it constitute a public offering of securities in any jurisdiction in Canada. The information contained herein is provided for informational purposes only and is not intended to be, nor should it be considered as, a complete description of either the securities or the issuer of the securities described herein.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.