Alternative Income Fund

Mandate:

Canadian Multi Strategy

Inception Date:

January 22, 2019

Fund Codes:

Class F CAD: NEW401

Class F USD: NEW401U

Class G CAD: NEW403

Class G USD: NEW403U

Management Fees:

Class F 1%

Class G 2%

Performance Fee

15%

Liquidity

Daily

Simplified Prospectus

2025

Summary of Investment Portfolio

2025

2024

Fund Fact Sheet

2024

- NewGen Alternative Income Fund – Class F (ENG)

- NewGen Alternative Income Fund – Class F (FRE)

- NewGen Alternative Income Fund – Class F (USD) (ENG)

- NewGen Alternative Income Fund – Class F (USD) (FRE)

- NewGen Alternative Income Fund – Class G (ENG)

- NewGen Alternative Income Fund – Class G (FRE)

- NewGen Alternative Income Fund – Class G (USD) (ENG)

- NewGen Alternative Income Fund – Class G (USD) (FRE)

- NewGen Alternative Income Fund – Class I (ENG)

- NewGen Alternative Income Fund – Class I (FRE)

Management Report of Fund Performance

2024

- Management Report of Fund Performance (ENG)

- Management Report of Fund Performance (FRE)

- Interim Management Report of Fund Performance (ENG)

- Interim Management Report of Fund Performance (FRE)

2023

- Management Report of Fund Performance (ENG)

- Management Report of Fund Performance (FRE)

- Interim Management Report of Fund Performance (ENG)

- Interim Management Report of Fund Performance (FRE)

Financial Statements

2024

- Audited Financial Statements Dec 31 2024 (ENG)

- Audited Financial Statements Dec 31 2024 (FRE)

- Interim Financial Statements June 30 2024 (ENG)

- Interim Financial Statements June 30 2024 (FRE)

2023

The NewGen Alternative Income Fund was launched in January 2019 under Canada’s new “Liquid Alternatives” regulatory framework; i.e. a hedge fund strategy available to retail investors through a prospectus offering. The Fund provides investors with exposure to (1) an actively managed diversified portfolio of dividend/income paying securities with a target portfolio yield of 4-5% (paid monthly); (2) a portfolio of stock-specific Alpha shorts to generate additional return and preserve capital by reducing market Beta; and (3) a multi-strategy overlay that relies on a broad range of strategies and securities in order to enhance yield, generate Alpha, and provide additional diversification benefits to our investors.

The NewGen Alternative Income Fund is offered to Canadian Investors only. US and other

international investors are not eligible.

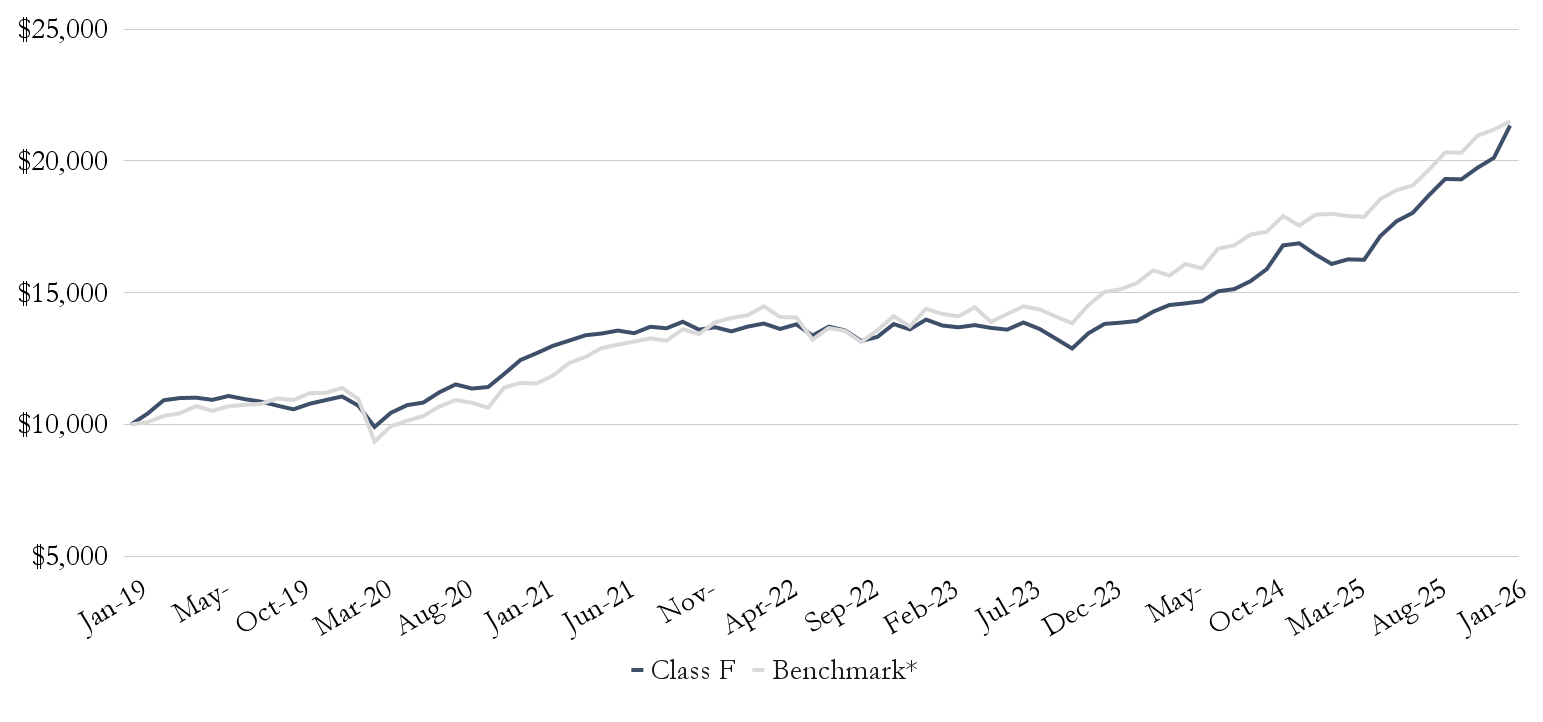

NewGen Alternative Income Fund: Growth of $10,000 Since Inception (Class F)

NewGen Alternative Income Fund (Class F)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD | ||

| 2019 | NG Alt Income Class F | 4.06% | 4.91% | 0.76% | 0.13% | -0.75% | 1.36% | -1.10% | -0.86% | -1.39% | -1.32% | 2.01% | 1.30% | 9.23% |

| Benchmark | 0.83% | 2.33% | 1.04% | 2.59% | -1.71% | 1.70% | 0.49% | 0.33% | 1.93% | -0.59% | 2.42% | 0.09% | 11.96% | |

| 2020 | NG Alt Income Class F | 1.25% | -3.16% | -7.53% | 5.38% | 2.81% | 0.91% | 3.62% | 2.66% | -1.36% | 0.50% | 4.41% | 4.40% | 13.93% |

| Benchmark | 1.70% | -3.73% | -14.78% | 6.30% | 2.06% | 1.81% | 3.50% | 2.29% | -0.93% | -1.76% | 7.27% | 1.47% | 3.36% | |

| 2021 | NG Alt Income Class F | 2.10% | 2.19% | 1.52% | 1.53% | 0.49% | 0.84% | -0.74% | 1.81% | -0.42% | 1.81% | -2.16% | 0.68% | 9.98% |

| Benchmark | -0.13% | 2.58% | 4.00% | 1.88% | 2.71% | 0.97% | 0.92% | 0.92% | -0.69% | 3.32% | -1.36% | 3.34% | 19.91% | |

| 2022 | NG Alt Income Class F | -1.15% | 1.34% | 0.85% | -1.49% | 1.29% | -3.09% | 2.53% | -1.04% | -2.96% | 1.18% | 3.65% | -1.45% | -0.59% |

| Benchmark | 1.19% | 0.75% | 2.36% | -2.83% | -0.08% | -5.98% | 3.31% | -0.78% | -3.14% | 3.42% | 3.93% | -2.76% | -1.14% | |

| 2023 | NG Alt Income Class F | 2.73% | -1.62% | -0.49% | 0.61% | -0.77% | -0.48% | 1.99% | -1.78% | -2.70% | -2.81% | 4.47% | 2.67% | 1.53% |

| Benchmark | 4.91% | -1.39% | -0.61% | 2.42% | -3.85% | 2.18% | 1.99% | -0.78% | -1.90% | -1.79% | 4.94% | 3.49% | 9.57% | |

| 2024 | NG Alt Income Class F | 0.33% | 0.47% | 2.52% | 1.77% | 0.43% | 0.54% | 2.58% | 0.57% | 1.99% | 2.95% | 5.67% | 0.48% | 22.14% |

| Benchmark | 0.66% | 1.57% | 3.12% | -1.26% | 2.83% | -1.07% | 4.72% | 0.77% | 2.42% | 0.61% | 3.45% | -2.02% | 16.75% | |

| 2025 | NG Alt Income Class F | -2.51% | -2.19% | 1.07% | -0.10% | 5.53% | 3.28% | 1.81% | 3.71% | 3.30% | -0.07% | 2.30% | 1.88% | 19.21% |

| Benchmark | 2.34% | 0.20% | -0.46% | -0.20% | 3.79% | 1.81% | 0.95% | 3.10% | 3.38% | -0.07% | 3.19% | 1.07% | 20.74% | |

| 2026 | NG Alt Income Class F | 6.09% | 6.09% | |||||||||||

| Benchmark | 1.49% | 1.49% |

*The benchmark is a custom measurement weighted 2/3rd to the S&P/TSX Composite Dividend Total Return Index and 1/3rd to the S&P Canada High Yield Corporate Bond Total Return Index

| 1-MTH | YTD | 1 -YR | 3-YR | 5-YR | INCEPTION |

|---|---|---|---|---|---|

| 6.09% | 6.09% | 29.7% | 15.2% | 10.9% | 11.3% |

The NewGen Alternative Income Fund began trading on January 22nd, 2019 – performance for the month reflects that

Standard deviation is a form of hypothetical performance data; Sharpe Ratio, Sortino Ratio and Jensen’s Alpha are hypothetical measures of excess return and we assume a risk-free rate of 1.5% in their calculations

This monthly distribution is fixed but not guaranteed and may be adjusted from time to time at the discretion of the fund manager.

The Fund’s current annualized yield is calculated based on the most recent monthly distribution assuming reinvestment, divided by the most recent month-end NAV

Portfolio exposures are all calculated as of the most recent calendar quarter-end

This document has been prepared by NewGen Asset Management Limited (“NewGen”, “we” or “us”). The information contained herein is not, and under no circumstances is to be construed as, an offer to sell or the solicitation of an offer to buy any securities nor does it constitute a public offering of securities in any jurisdiction in Canada. The information contained herein is provided for informational purposes only and is not intended to be, nor should it be considered as, a complete description of either the securities or the issuer of the securities described herein.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.